Gas Detection Systems: Technology Options and Implementation Strategies for Work Environments

In many industries—ranging from manufacturing and mining to laboratories, oil and gas, and construction—the risk of hazardous gases...

Specific Risks of Using Equipment in Closed Environments

Operating industrial equipment in closed or enclosed environments creates a unique set of hazards that differ significantly from outdoor...

Regulatory Framework for LPG Use: OSHA Requirements, NFPA Standards, and Industry Guidelines

The use of Liquefied Petroleum Gas (LPG) in industrial applications, particularly in material handling equipment like forklifts, operates...

The Critical Importance of Proper Footwear for Standing Position Jobs

For millions of workers who spend their days on their feet—from retail associates and factory workers to healthcare professionals and...

Workplace Air Quality Management: Beyond Basic Ventilation

Indoor air quality has emerged as a critical workplace safety concern that extends far beyond traditional industrial hygiene...

Machine Guarding Essentials: Preventing Caught-In and Struck-By Accidents

Industrial machinery powers modern manufacturing, but it also presents some of the most serious hazards in the workplace. Every year,...

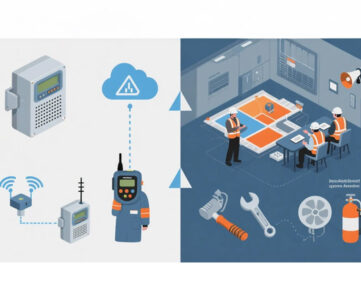

Lone Worker Safety: Protecting Employees Who Work in Isolation

Across industries, millions of employees work alone—far from immediate help when emergencies arise. From security guards patrolling empty...

OSHA Launches Hearings on New Heat Protection Rule for Workers

The Occupational Safety and Health Administration (OSHA) has started a series of informal public hearings as part of its process to...

The Hidden Costs of Safety Shortcuts: A Financial Analysis of Why Cutting Corners Never Pays

In business environments where every dollar counts and efficiency drives competitive advantage, safety investments can sometimes feel like...

Sleep and Safety: Addressing Shift Work Challenges and Fatigue-Related Incidents

In our 24/7 economy, millions of workers operate outside traditional daytime schedules, working nights, rotating shifts, or extended hours...